how much of my paycheck goes to taxes in colorado

Calculating your Colorado state income tax is similar to the steps we listed on our Federal paycheck calculator. 2000 6000 7500.

Which States Pay The Most Federal Taxes Moneyrates

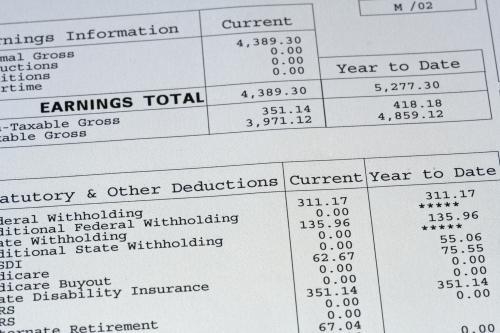

Luckily when you file your taxes there is a deduction that allows you to deduct the half of the FICA taxes that your employer would typically pay.

. FICA taxes consist of Social Security and Medicare taxes. FICA taxes are commonly called the payroll tax. Income ranges between 0 and 108 In the US the tax rate is 15 for incomes over 109 but not more than 1088.

Disagree with your Billing Notice. The next 30000 would be taxed at 20 or 6000. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Payroll tax is 153 of an employees gross taxable wages. Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Colorado Salary Paycheck Calculator.

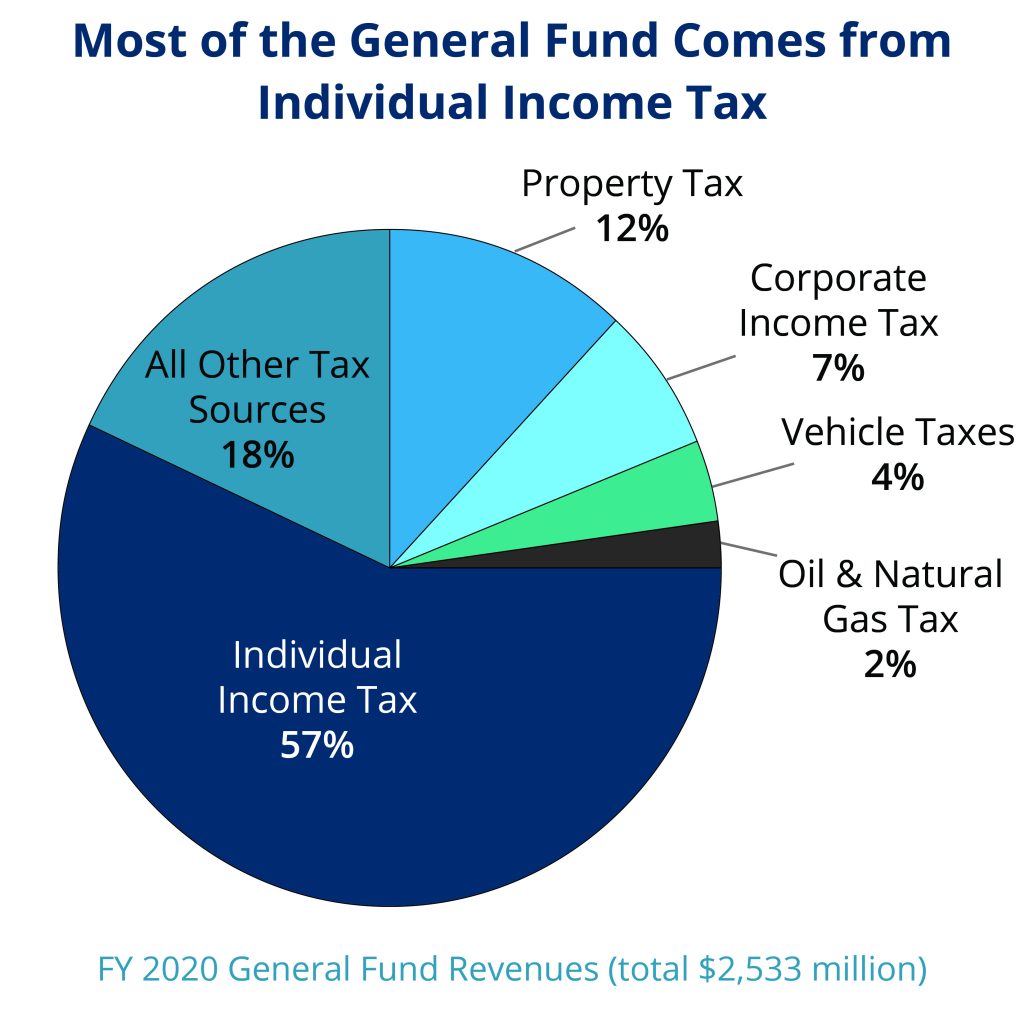

In total Social Security is 124 and Medicare is 29 but the taxes are split evenly between both employee and employer. More specifically marijuana retailers must pay a 15 excise tax when they buy from a cultivator leaving consumers to pay the other 15 in the form of a sales tax at the time of purchase. The first 20000 of that would be taxed at 10 or 2000.

You pay the tax on only the first 147000 of your. About Employer Withholding Taxes. Employer payroll tax rates are 62 for Social Security and 145 for Medicare.

How much is payroll tax in PA. If you cannot completely pay your outstanding tax balance due you may request a payment plan also called an installment agreementThe Department may allow you to make monthly payments until your debt is fully paidMore information can be found on the Payment Plan web page. Unable to Pay in the Balance Full.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Just enter the wages tax withholdings and other information required. How Much Of Your Paycheck Goes To Taxes And Why.

The next 30000 would be taxed at 20 or 6000. And if youre in the construction. You make 15 an hour and you worked 80 hours over the past two weeks.

The state income tax in Colorado is assessed at a flat rate of 463 which means that everyone in Colorado pays that same rate regardless of their income level. The final 25000 of your income would be taxed at 30 or 7500. The 29 state sales tax rate only applies to medical marijuana.

Colorado Unemployment Insurance is complex. There is no estate or inheritance tax in Colorado. It changes on a yearly basis and is dependent on many things including wage and industry.

Your total tax would be. The result is that the FICA taxes you pay are. So how much is the employer cost of payroll taxes.

So the tax year 2022 will start from July 01 2021 to June 30 2022. The final 25000 of your income would be taxed at 30 or 7500. Pay Individual Income Tax.

Payment Due with Return Filing. Its your first payday at a new job. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state.

Employers are required to withhold PA personal income tax at a flat rate of 307 percent of compensation. However they dont include all taxes related to payroll.

2022 State Tax Reform State Tax Relief Rebate Checks

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Colorado Proposition 116 Decrease Income Tax Rate From 4 63 To 4 55 Initiative 2020 Ballotpedia

Colorado Businesses That Owed State Taxes Got Ppp Loans 9news Com

How To Read Your W 2 University Of Colorado

Colorado Paycheck Calculator Smartasset

:max_bytes(150000):strip_icc()/how-much-do-i-budget-for-taxes-as-a-freelancer-453676_V1-b2584d2f80b043d0814fca81c1b1fecf.jpg)

How To Budget For Taxes As A Freelancer

What Are Payroll Taxes Forbes Advisor

Call Center Set Up In Colorado For Tabor Refund Checks 55 Of Checks Mailed Out Have Been Cashed As Of Aug 17

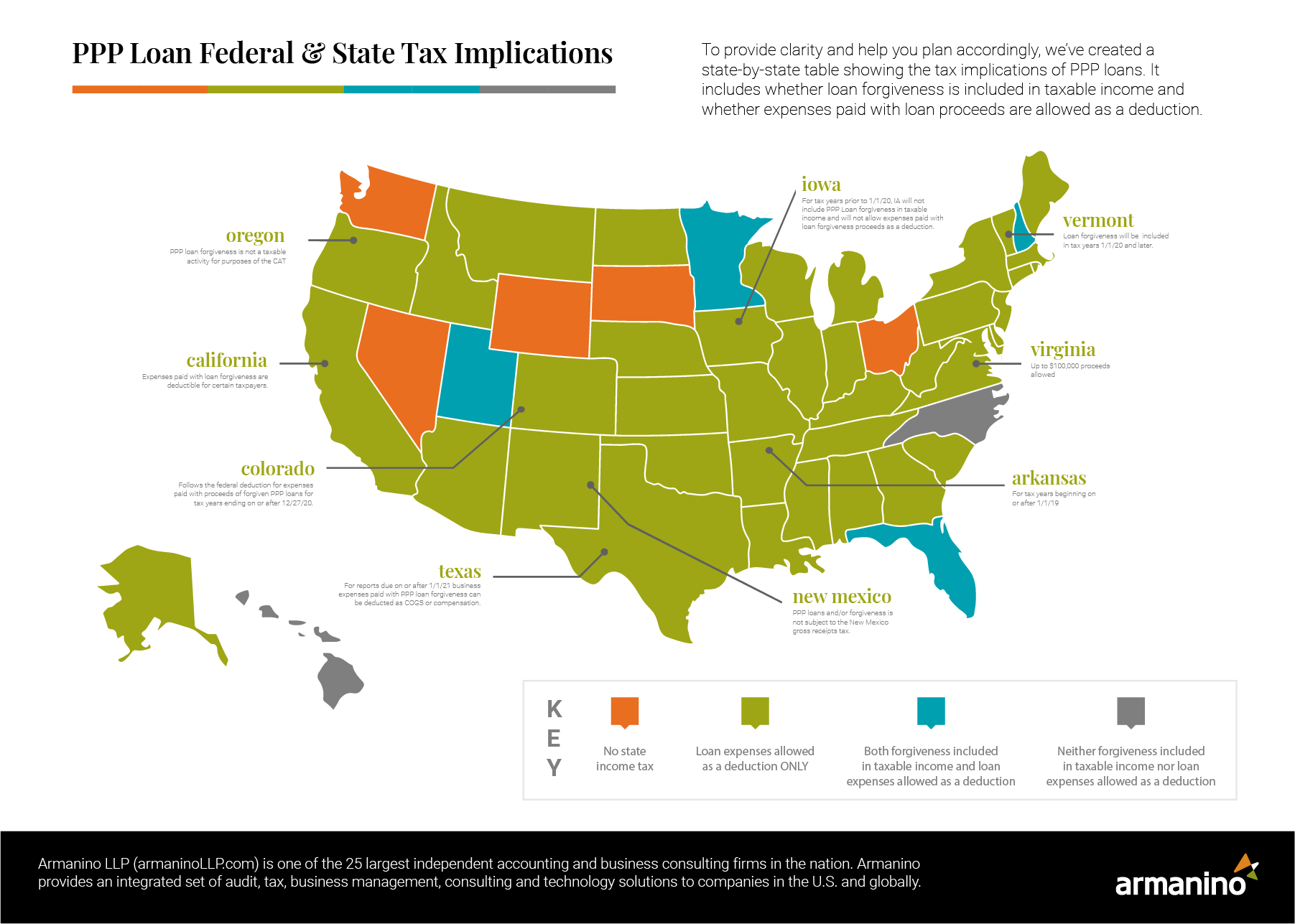

Ppp Loan Tax Implications Armanino

Percent Of Your Income Is Going To Taxes

Income Definition Exceptions Colorado Family Law Guide

Colorado State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

What Is Local Income Tax Types States With Local Income Tax More

Policy Basics Individual Income Taxes In Montana Montana Budget Policy Center

Tax Day 2016 Charts To Explain Our Tax System Committee For A Responsible Federal Budget